Blog

Insights, Trends & Market News

You don’t give your money away for nothing. But that’s exactly what you do when you don’t take advantage of opportunities to minimize your taxes. One of the best ways to retain more of your wealth is to reduce the burden of taxation. And this isn’t something to deal with once a year when tax day comes; ongoing tax planning can help you strategically reduce your tax bill so the IRS doesn’t get more of your money than they should.

If you understand the rules of the game, you will have a much higher success rate at winning. The same is true for understanding tax law. If you understand tax law and the benefits available to taxpayers, then when it comes to “winning the game” of reducing your tax bill, you will be that much better off. Here’s how to make that happen.

Create a Tax-Efficient Retirement Plan

When working with your advisor to create your financial plan, retirement planning will often be a key point of conversation. By stress-testing your plan, you can quickly see if your current retirement accounts, savings rates, and other assets will be adequate for the retirement lifestyle you desire.

A direct way to reduce your tax bill is to contribute money into tax-deferred savings accounts, such as a 401(k) or IRA. But in order to maximize your savings, you need to determine both your current cash flow needs and your ideal retirement income. A financial plan will look at both factors and determine the best way to use your tax-deferred savings accounts to save you money both now and in the future. For example, a $50,000 withdrawal from a Roth IRA will have a wildly different tax impact than that same distribution from a traditional IRA. Creating a tax plan can help you strategically withdraw from your various retirement accounts and reduce your tax liability.

Contribute to a Health Savings Account

As a refresher, health savings accounts (HSAs) offer a triple-tax savings. It may sound too good to be true, but HSAs have no federal income tax, no state or local taxes, and no Federal Insurance Contribution Act (FICA) taxes. If you are eligible for an HSA, your money will be tax-deferred and can be withdrawn tax-free to pay for medical expenses.

Because HSA account balances simply roll over from year to year, by contributing to the limit each year, you can build up quite a nest egg to cover either current medical expenses or future medical expenses in retirement. Think of it as a Roth IRA for medical expenses. For 2022, HSA owners now have higher contribution limits to help them do just that. If you have individual coverage, you can contribute $3,650, and for family coverage, your limit is $7,300, with an extra catch-up contribution of $1,000 available for those over age 55. (1) If you can’t max out the yearly limit, attempt to contribute enough to cover your deductible and take advantage of your employer match, if available.

Use a Roth IRA to Transfer Wealth

Roth IRAs are an attractive savings vehicle for many reasons, including no required minimum distributions (RMDs), tax-free withdrawals after age 59½, and the ability to pass wealth tax-free to your heirs.

You probably know the effects taxation can have on your assets and the inheritance you hope to pass on to future generations. For example, if you passed down a traditional IRA, non-spouse beneficiaries used to be able to stretch out the distributions from that account over the beneficiary’s life, but now they have to liquidate the account within 10 years of inheriting it (with some exceptions), thanks to the new SECURE Act. This significantly decreases the value of the account due to the amount of taxes paid in a short time.

But if you pass down a Roth IRA instead, there is no income tax due on the distributions as long as the account is held for more than five years and the account holder is 59½ or older.

If you have traditional IRAs already or earn too much to qualify for a Roth IRA, consider a Roth conversion to remedy the tax loss. The basic process to convert your IRA is to withdraw the amount you’d like to invest in a Roth, pay the tax owed on the distribution, then reinvest it into a Roth account. Be sure to work with a professional to determine the best time to do this so you don’t push yourself into a higher tax bracket or be forced to use funds from the account to pay the extra taxes on the distribution. Also, stay on top of potential tax changes that could limit the availability of this option for you. (2)

Deduct Eligible Charitable Contributions

Annual gifts to qualified charitable organizations may be deemed an eligible itemized deduction. Under the Tax Cuts and Jobs Act, fewer taxpayers itemize deductions due to the doubling of the standard deduction. (3) Regardless, charitable giving is still a useful tax-minimization strategy.

In order to benefit from charitable giving, you’ll have to plan ahead. With the new higher standard deduction, you’ll need to make sure your total deductions for the year, giving included, exceed $12,950 for an individual filer, and $25,900 for married filing jointly. (4) If your deductions fall below this amount, consider bunching your giving or doing several years’ worth of giving in one year.

You may also want to look into using a donor-advised fund to combine all charitable contributions in a year and then distribute the funds to various charities over several years. With this strategy, you may be able to itemize deductions in one year and take the standard deduction in the following years so you can achieve a tax benefit that you may not have received otherwise.

Review Your Previous Tax Returns

You can learn a lot from the past. Look at your previous tax returns with a professional to search for deductions or credits you may have missed, opportunities to lower taxable income, and plan for the next tax season. Take these factors into consideration when making a tax plan for the future:

- Review notable tax law changes for 2021 that may affect you.

- Review your capital gains and losses.

- Review your retirement savings options.

- Consider Roth IRA conversions.

- Consider additional year-end tax strategies.

- Understand potential tax law proposals.

Getting Ahead With Tax Planning

Tax planning could potentially save you money, both today and in the future, but while beneficial, taxes can be complicated—it’s estimated that it would take you eight weeks of nonstop reading to get through the lengthy and complicated IRS tax code, which is filled with various opportunities and strategies for optimal tax efficiency. (5) The key is partnering with an experienced professional who can help you understand how each possible opportunity works and how it fits into your strategy and long-term goals.

With years of experience in financial and tax planning, the Rosemeyer Management Group team knows how to implement appropriate tax-minimization strategies to help you save more of your hard-earned money. If you have questions about any of these tax strategies and whether they’d be right for you, we encourage you to reach out to us. Schedule an introductory appointment online or by calling us at 608-348-2274. For any questions, feel free to reach out to me at kaley@rosemeyermg.com.

About Kaley

Kaley Bockhop is an investment advisor representative at Rosemeyer Management Group, an SEC Registered Investment Advisor based in Platteville, WI. Kaley’s experience in taxes and accounting and her financial planning expertise allows her to help her clients work toward their retirement goals and set themselves up for success. It is Kaley’s goal to partner with her clients to build a customized road map for their finances so they can look forward to a comfortable retirement and decrease financial worry. Kaley is a CPA and a CERTIFIED FINANCIAL PLANNER™ professional. She has a bachelor’s degree in science from the University of Wisconsin-Platteville with a triple major in accounting, agricultural business, and animal science, and a minor in biology. In her free time, Kaley enjoys working on her family’s farm where they raise nationally recognized registered Angus show cattle. She also loves exercising and traveling. To learn more about Kaley, connect with her on LinkedIn.

____________

(1) https://www.irs.gov/pub/irs-drop/rp-21-25.pdf

(3) https://www.cnbc.com/2019/06/18/post-tax-reform-charitable-contributions-took-a-hit-in-2018.html

(4) https://www.forbes.com/advisor/taxes/standard-deduction-2021-2022/

(5) https://irisreading.com/how-long-would-it-take-to-read-the-entire-u-s-tax-code/

A new year is upon us! The turning of the calendar is usually considered a time for fresh starts, intentional planning, and renewed motivation to conquer goals and accomplish things that are important to you (hence the tradition of New Year’s resolutions). And after the last couple years we’ve had, a truly fresh start is just what we need. As you transition into 2022 and all this year will bring, take some time to think about your long-term plans and reevaluate your decisions, especially in the following key areas.

Tax Strategy Planning

In the wake of a change in administration, questions naturally arise about how tax laws could change and how that will affect your wallet. If tax rates increase for your tax bracket, (1) you may want to reconsider your savings and investing strategies. Keep in mind Biden’s Build Back Better Agenda (2): The $1.2 trillion infrastructure portion of the bill was signed into law in November and the social spending part of the bill, which will involve many tax changes, was recently passed by the House and is awaiting approval in the Senate. (3)

The social spending bill has far-reaching implications for people in all tax brackets, and it’s important to review the changes with a qualified professional in order to fully understand how your financial plan will be impacted and to put you in a better position to minimize any detrimental effects.

Because of how often new tax legislation is introduced, tax planning is not a one-and-done deal. Revisit your plan to make some shifts that will benefit you in the long run.

Tracking Retirement Funds

As we learned from the Great Recession, it is important to stay proactive when it comes to your cash flow and retirement funds. The temptation to adopt a “set it and forget it” approach can create financial blind spots, especially when the demands of work and family make it challenging to carve out time to review finances. Make sure you or your financial advisor is on top of tracking and monitoring your investment accounts, retirement plan balances, and other assets, and commit to start keeping a pulse on the health of your family’s finances at least once a quarter, if not monthly.

Insurance Coverage

Inadequate insurance coverage is a common issue that can derail retirement plans, especially in the event of unforeseen health problems or injuries that force individuals to retire early. A 2020 study found that only 54% of Americans have life insurance, and that 40% of policyholders reported that they wished they had bought coverage sooner. (4) Applying for coverage at a younger age can result in lower premiums, and policies of varying term lengths can be stacked so that your coverage decreases over time as your investment assets increase and your need for insurance decreases. It’s prudent to make sure you have the proper policies and coverage for your unique situation.

Estate Planning

Regularly reviewing your estate plan is a crucial component of your financial strategy. Life moves quickly, and it is all too easy to forget how much can happen in a short period of time. Arrivals of new children or grandchildren, health conditions, asset purchases or liquidations (such as buying a new home), marriage/divorce, retirement, unemployment, remarriage, and deaths in the family can make a significant impact on the big picture of your estate plan. Additionally, potential changes in estate tax law which have been mentioned by the new Biden administration (such as reducing the estate tax unified credit) can necessitate revisions to your estate plan. Certain estate planning techniques can aid you in achieving your wealth transfer goals, whether they include bequests to individuals or philanthropic organizations, in a more tax-efficient way, allowing your heirs and charities to receive increased benefits.

Let Us Partner With You

As we settle into the new year, it’s wise to anticipate and prepare for the changes that every season of life brings. By February, most people give up on those popular New Year’s resolutions; so move toward securing your financial future now by checking off some of these items.

If you are ready to reassess your long-term goals or would like to discuss how to build a solid foundation for your future, our Rosemeyer Management Group team is here to help. Our comprehensive process not only designs a customized plan for your unique future, but also accounts for the inevitable life changes that happen along the way, allowing you to breathe easier. If you need help with your plan, schedule an introductory appointment online or by calling us at 608-348-2274. For any questions, feel free to reach out to me at andrew@rosemeyermg.com.

About Andrew

Andrew Tranel is co-owner and chief investment officer at Rosemeyer Management Group, an SEC Registered Investment Advisor based in Platteville, WI. With 10 years of experience, Andrew specializes in providing retirement planning, tax planning, estate planning, and insurance needs for his retiree and pre-retiree clients with the goal of helping them develop a road map to financial freedom. He is known for his expertise in helping people make empowered and educated decisions about their retirement so they can confidently navigate the pre-retirement challenges they face. Andrew has a bachelor’s degree in finance and sport management from Loras College and is a CERTIFIED FINANCIAL PLANNER™ professional. When he’s not working, you can find Andrew spending time with his wife, Kimberlee, their three sons, Steven, Elliott, and Weston, and their beloved boxer, Bella. He also enjoys hunting, golfing, playing basketball and softball, and traveling. To learn more about Andrew, connect with him on LinkedIn.

_____________

(2) https://rules.house.gov/sites/democrats.rules.house.gov/files/BILLS-117HR5376RH-RCP117-18.pdf

(4) https://www.policygenius.com/life-insurance/life-insurance-statistics

It’s not about the money you have—it’s what you do with it. This was one of the first major life lessons I learned, and it still shapes how I approach financial management today.

Growing up on a farm, I had plenty of opportunities to develop a strong work ethic, and thankfully, my dad also had the foresight to teach me the value of money through hard work. As a young girl, I would spend my summers mowing the farm, helping my dad load hogs, among other things, earning minimum wage. When I had worked enough hours to make my paycheck amount to something, my dad wrote me a check. I could then purchase the things I wanted and was also “forced” to put a set amount of my earnings into savings. That wasn’t fun at the time, but as I watched my money grow, I saw the potential in it.

These experiences, combined with my love for numbers, formed the foundation of my decision to make a career for myself in the financial industry.

From Point A to Point B

After graduating from the University of Wisconsin-Platteville with a bachelor’s degree in both accounting and agricultural business (those are my farm roots showing again), I started working in the tax and accounting world. As a CPA, my interactions with my clients taught me that finances don’t exist in a bubble. What you do with your money is not only impacted by what you value, but it also impacts multiple areas of your life. I wanted to add more value to my clients’ lives, so I made a shift and became a financial advisor, earning the CERTIFIED FINANCIAL PLANNER™ certification and joining the team at Rosemeyer Management Group.

Fast-Forward to Today

Now, as an investment advisor, I get the ultimate privilege of giving my clients the education and guidance that can help them make their financial dreams a reality. Through customized, comprehensive financial planning, we can integrate all areas of their finances into a cohesive plan, from investment strategies and tax planning to risk management and retirement planning.

With each passing year that I do this important work, I get to witness more and more of my clients reach new levels, surpass their goals, or create wealth they didn’t even know was possible. I love going on the journey with them, helping them overcome challenges, learning where they’ve been, and celebrating their successes.

For many, finances are a major part of their life—either creating stress and worry, or opening doors for them. Despite being naturally goal-driven, my true motivation for my work comes from seeing how our strategies, decisions, and recommendations have been life-changing for those I serve.

The Next Step

Pursuing and achieving goals is much easier when you aren’t alone in the process. A helpful guide and advocate can make all the difference. If you’re interested in learning more about how I can help, I encourage you to schedule an introductory appointment online or by calling us at 608-348-2274. For any questions, feel free to reach out to me at regan@rosemeyermg.com.

About Regan

Regan Shipp is an investment advisor representative at Rosemeyer Management Group, an SEC Registered Investment Advisor based in Platteville, WI. Regan is known for building relationships and looking at the whole picture of her clients’ lives to provide personalized, comprehensive wealth management services and advice. She leaves no stone unturned as she integrates investment strategies, risk management strategies, tax planning, retirement planning, and estate planning to design a plan that will help her clients pursue both financial success and freedom throughout their lives. Regan strives to educate her clients so they can feel empowered to take the actions necessary to achieve their goals. Regan is passionate about making a difference in people’s lives and loves journeying with her clients and seeing them reach new levels, surpass goals, and create wealth they might not have known was possible. Regan has a bachelor’s degree in accounting and agricultural business from the University of Wisconsin-Platteville and is a Certified Public Accountant (CPA) and CERTIFIED FINANCIAL PLANNER™ professional.

With a world of information at our fingertips, we can find reviews, history, product specifications, and more details than we’ll ever need about anything we want to buy. In other words, before making a major purchase, we can arm ourselves with information to make the best choice possible.

While creating a financial plan is in a different category than buying a car or putting an offer on a home, we believe it’s just as significant of an investment and you should know what you’re getting before you pay a penny.

Because we develop custom financial plans for each client, it’s no easy task to provide one without working with you extensively. However, we wanted to share what your potential financial plan could look like so you can picture the depth of our analysis and how this understanding can benefit your future financial life. If you choose to work with us, here is a sample of what you can expect.

What Does a Financial Plan Include?

First, you may be wondering about what goes into a comprehensive plan. Financial plans often address a myriad of concerns and goals, from college planning to retirement income strategizing. Depending on your needs, your plan may narrow in on one element or address multiple goals you’d like to achieve over time, such as understanding your true cost of living before you retire, ensuring your money lasts throughout your life, and reducing the taxes you pay in retirement. Whatever you choose to focus on, your financial plan is designed to serve as your road map, helping you navigate the years before, during, and after your transition to retirement.

We believe a good financial plan should give you a detailed, complete view of your current financial situation, a thorough modeling of where you want to be, and the actions you need to take to reach those goals. It should address all the pieces of your financial puzzle, from stresses and fears to your values and dreams, and include risk factors, cash flow, retirement, estate planning, taxes, education, and income strategies to help bring you clarity and guidance. It is through our planning process that we can help you prepare for life’s expected and unexpected circumstances.

The result is a simple yet powerful blueprint to guide you toward financial freedom.

Let’s Take a Closer Look

Here is a sample financial plan that reflects our planning process. It looks at a fictional client’s lifestyle income plan and how we developed it, including identifying their goals, creating a balance sheet, reviewing their cash flow, and more.

Keep in mind that this is only a hypothetical plan presented to illustrate what a client’s plan may resemble should they work with us. The characters and circumstances are completely fictional and are for illustrative purposes only. Be sure to seek the advice of a qualified professional for your particular situation and not rely upon any of the information herein to make personal financial decisions.

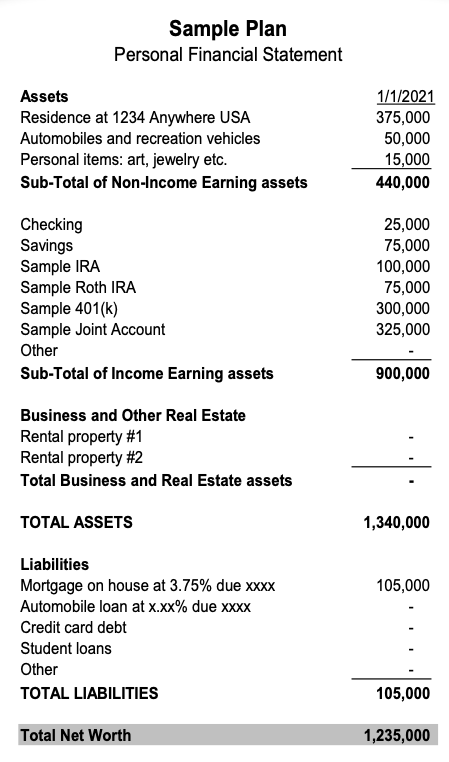

We provide an overview of your current situation. With just one glance, you can see a big picture of your financial life, including assets broken down into specific categories and short-term and long-term liabilities.

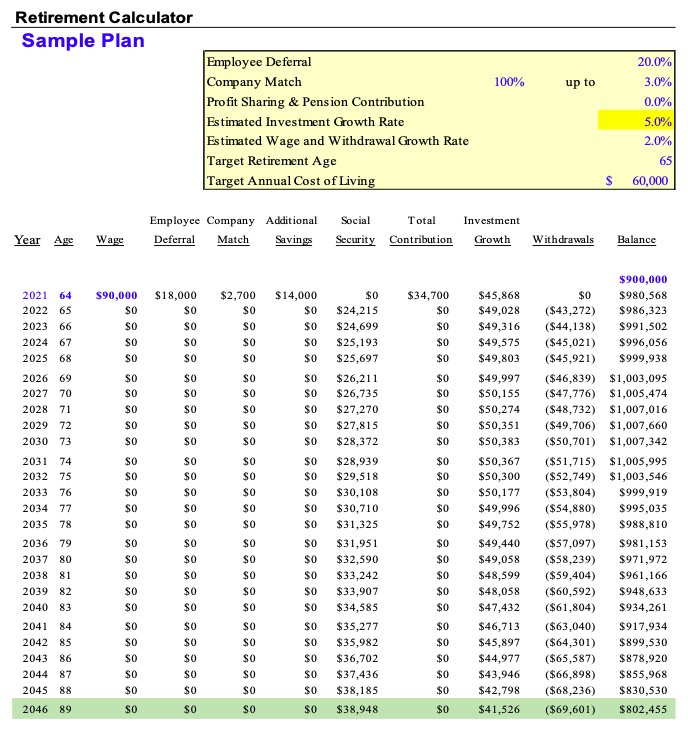

Our financial planning is goals-based. This means we help you develop specific budgets for your future goals and needs—pre and post retirement. This approach allows us to more accurately predict your future spending needs and accommodate for how those needs will change over time. Our advanced planning software allows us to bring all these things together in a comprehensive way that makes sense and test multiple scenarios to determine retirement readiness.

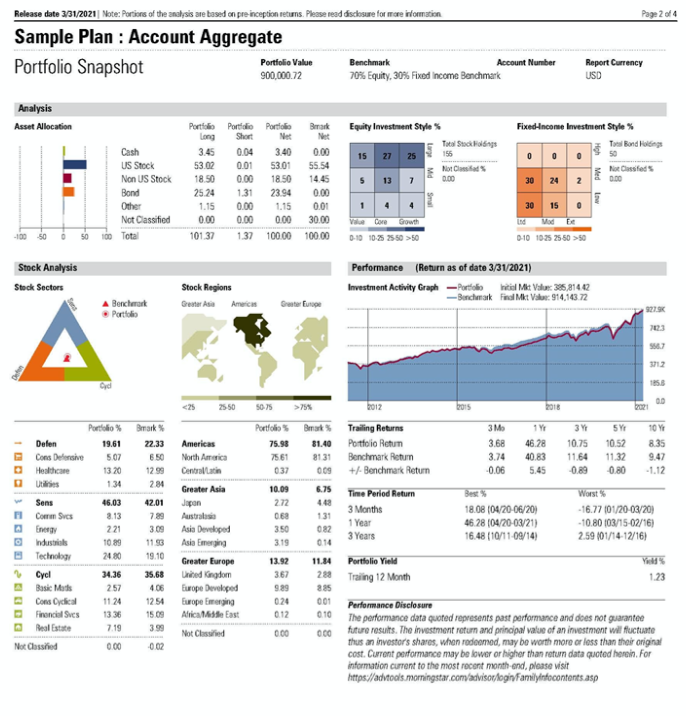

When it comes to investments, we will analyze your current investment holdings and continuously monitor your portfolio to ensure your investments are still on track toward your goals.

In addition to a detailed study of each of your goals and a clearly mapped-out plan to get you there, we also create a risk management plan to cover your bases and give you increased peace of mind. The end result? An actionable implementation list and a road map for your future.

Get Started on Your Plan!

If you want to see even more features of our financial plans, download our full sample plan. Once you’ve taken a look, reach out to us at Rosemeyer Management Group today to schedule an introductory appointment online or by calling us at 608-348-2274. For any questions, feel free to reach out to me at andrew@rosemeyermg.com.

About Andrew

Andrew Tranel is co-owner and chief investment officer at Rosemeyer Management Group, an SEC Registered Investment Advisor based in Platteville, WI. With 10 years of experience, Andrew specializes in providing retirement planning, tax planning, estate planning, and insurance needs for his retiree and pre-retiree clients with the goal of helping them develop a road map to financial freedom. He is known for his expertise in helping people make empowered and educated decisions about their retirement so they can confidently navigate the pre-retirement challenges they face. Andrew has a bachelor’s degree in finance and sport management from Loras College and is a CERTIFIED FINANCIAL PLANNER™ professional. When he’s not working, you can find Andrew spending time with his wife, Kimberlee, their three sons, Steven, Elliott, and Weston, and their beloved boxer, Bella. He also enjoys hunting, golfing, playing basketball and softball, and traveling. To learn more about Andrew, connect with him on LinkedIn.

A survey of retirees found that 56% of Americans are worried about having financial security in retirement. (1) It’s no wonder retirement planning is stressful to so many. Even if you have an ample nest egg, risk factors like healthcare costs, inflation, and market volatility are out of one’s control, making it impossible to predict how well your retirement savings will last the rest of your life. Thankfully, there are some things you can control that can make all the difference in maintaining your lifestyle in retirement without fear of running out of money.

Plan, Then Plan Some More

While it’s true that you can’t predict the future, you can alleviate some of the stress from uncertainty with thorough preparation. The retirement planning process goes beyond common financial rules of thumb to identify your specific goals and time horizon, assess your current financial situation and future retirement income needs, and create strategies for saving and investing to reach your retirement goal. Consider your retirement plan a road map to your goals. With it, you can be confident that you’re heading in the right direction.

Once your retirement plan is in place, review it regularly and make necessary adjustments to keep your plan on track. Along the way, you may need to refine your spending habits, savings rates, investment allocations, or planned retirement age.

Don’t Let Long-Term Care Wipe Out Your Assets

Long-term care expenses have the potential to devastate a retirement portfolio. Someone turning 65 today has an almost 70% chance of needing long-term care services in their remaining years, with an average duration of services of three years. (2) In 2020, the median cost for a home health aide was $4,576 per month, whereas a private room in a nursing home was $8,821 per month. (3) While home healthcare services have lower fees than a facility, they are used longer.

No matter what your health looks like today, it’s important to incorporate a plan to pay for long-term care costs in your retirement plan. Depending on your lifestyle and needs, some options for addressing long-term care include traditional long-term care insurance, a life insurance policy or annuity with a long-term care rider, or self-funding.

Know How Much You Can Spend in Retirement

When you’re ready to retire, an established withdrawal plan will go a long way in putting your mind at ease that your savings will last. A common rule of thumb is to limit withdrawals to 4% of your portfolio to avoid spending down assets too soon. However, your safe withdrawal rate depends on your asset mix at retirement and how long you need your assets to last and will require adjustment over time.

Careful distribution planning allows you to stretch your retirement assets further, giving you the best chance that your retirement income and portfolio assets will be sustainable throughout your lifetime. Your financial advisor can help you create a withdrawal strategy that navigates required minimum distributions and other withdrawals for tax efficiency, analyzes whether to delay Social Security benefits, and minimizes portfolio withdrawals during market downturns.

Need Help Making Your Money Last?

At Rosemeyer Management Group, we like to say that personal finance is, well…personal. There’s no single answer to when you can retire or how much money you need to live a comfortable life. Finding these answers begins with us doing a thorough deep dive into your financial situation and goals, so we can determine what steps you need to take to get where you want to be.

If you’d like help figuring out how to secure your money through retirement, schedule an introductory appointment online or by calling us at 608-348-2274. For any questions, feel free to reach out to me at regan@rosemeyermg.com.

About Regan

Regan Shipp is an investment advisor representative at Rosemeyer Management Group, an SEC Registered Investment Advisor based in Platteville, WI. Regan is known for building relationships and looking at the whole picture of her clients’ lives to provide personalized, comprehensive wealth management services and advice. She leaves no stone unturned as she integrates investment strategies, risk management strategies, tax planning, retirement planning, and estate planning to design a plan that will help her clients pursue both financial success and freedom throughout their lives. Regan strives to educate her clients so they can feel empowered to take the actions necessary to achieve their goals. Regan is passionate about making a difference in people’s lives and loves journeying with her clients and seeing them reach new levels, surpass goals, and create wealth they might not have known was possible. Regan has a bachelor’s degree in accounting and agricultural business from the University of Wisconsin-Platteville, is a Certified Public Accountant (CPA), and recently passed the CERTIFIED FINANCIAL PLANNER™ exam.

When she’s not at work, you can often find Regan spending time with her friends and family or out on a run training for a half or full marathon. Regan and her husband, Payton, and their dog, Axel, love the outdoors and look forward to more camping, deer hunting, and beach trips. To learn more about Regan, connect with her on LinkedIn.

___________

(1) https://www.nirsonline.org/wp-content/uploads/2021/02/FINAL-Retirement-Insecurity-2021-.pdf

(2) https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

(3) https://www.genworth.com/aging-and-you/finances/cost-of-care.html

There’s no better way to choose a career than by gaining firsthand experience that opens your eyes to how many people need the help you can offer. That’s my story at least.

I started in the finance industry as a CPA and spent years helping my clients navigate the complicated world of taxes. Not only was it difficult to see my clients continually stressed and worried about what problems would come up or the possibility of getting audited (no one actually enjoys meeting with their accountant!), but I began to understand the importance of having all areas of your financial life aligned and working together in pursuit of your goals.

I felt I could be an even greater support by providing more services. Instead of just telling my clients how much they owed in taxes, I wanted to help them avoid costly mistakes and organize their entire financial picture. That meant a slight career pivot was in order. Financial planning was the natural next step to make an even greater impact on my clients’ lives.

Then and Now

Before diving into the world of financial advising, I attended the University of Wisconsin-Platteville and graduated with a bachelor’s degree in science with a triple major in accounting, agricultural business, and animal science, and a minor in biology. (Yes, that’s quite the mix—but all those degrees have been put to good use. You can find me spending the weekends working with my Angus cattle at my family’s farm.) After earning my CPA license, I worked for a variety of companies as a tax specialist and tax and accounting manager. I enjoyed the work, but it became taxing (pun intended) to help with only one limited part of people’s financial concerns. When I decided to branch out, I became a CERTIFIED FINANCIAL PLANNER™ professional and joined the team at Rosemeyer Management Group.

Now, after some time doing this important work, I’m fully convinced I made the best decision. As an investment advisor, I spend my days helping my clients grow their money and proactively plan for whatever the future may hold. I partner with my clients to build a personalized plan with solutions and strategies designed to make their financial goals a reality. I also combine my tax and financial planning knowledge to ensure that all aspects of their finances are in order.

My passion for what I do comes from my clients. They work so hard and just want to know that their future will be marked by financial security rather than worry and stress. My goal is to relieve some of that burden by supporting and equipping them through the decisions and situations they face. If at the end of the day, my clients feel like they are taken care of and they don’t need to worry about their investments, that’s a win!

Why I Love What I Do

You may not think that celebrating is part of a financial advisor’s job, but that’s my favorite part of what I do. It’s incredibly fulfilling and inspiring to share with a client that they are now financially ready to step into retirement or pursue a lifelong dream. I have the privilege of walking alongside my clients, cheering them on, and giving them the tools they need to turn their hard work into an enjoyable life.

Want to Know More?

Don’t just take my word for it—experience the difference a dedicated, relationship-based financial advisor can make in your life. Take the first step toward your ideal future by scheduling an introductory appointment online or by calling us at 608-348-2274. For any questions, feel free to reach out to me at kaley@rosemeyermg.com.

About Kaley

Kaley Bockhop is an investment advisor representative at Rosemeyer Management Group, an SEC Registered Investment Advisor based in Platteville, WI. Kaley’s experience in taxes and accounting and her financial planning expertise allows her to help her clients work toward their retirement goals and set themselves up for success. It is Kaley’s goal to partner with her clients to build a customized road map for their finances so they can look forward to a comfortable retirement and decrease financial worry. Kaley is a CPA and a CERTIFIED FINANCIAL PLANNER™ professional. She has a bachelor’s degree in science from the University of Wisconsin-Platteville with a triple major in accounting, agricultural business, and animal science, and a minor in biology. In her free time, Kaley enjoys working on her family’s farm where they raise nationally recognized registered Angus show cattle. She also loves exercising and traveling. To learn more about Kaley, connect with her on LinkedIn.

I didn’t know this at the time, but my career path was already set in action when I was just a child. It all started back when my mom and dad gave me 50 cents a week for my allowance and taught me to give half of it to our church and save the other half. As you can imagine, young Jacob was not too pleased with this arrangement. My friends were given $20 or even $100 for their allowance without having to do chores to earn it, and there I was, making 50 cents for cleaning toilets.

Now, with many more years of wisdom and experience behind me, I can see that my parents gave me a gift—they showed me the value of a dollar and the importance of giving and saving (although I have also learned the joy of spending and investing into things I love). Add that to my natural skill with numbers and my passion for helping others and building relationships, and there it was, the perfect career for me.

The Journey

After earning my bachelor’s degree in business management from Edgewood College, I spent a handful of years in various roles, including working as a legislative aid for the Wisconsin State Assembly. I eventually came back to my love of numbers and joined Rosemeyer Management Group, a firm founded by my father, James Rosemeyer, when he saw a need for relationship-based comprehensive wealth management.

Now I am co-owner and chief executive officer, working one-on-one with my clients to help them navigate the financial decisions they face and provide them with personalized strategies to help them grow and preserve their wealth. I focus on resourcing and educating my clients, not just handing them a plan and sending them on their way. I’m passionate about giving them an understanding of their finances so they can see the possibilities of where their money can take them—to a more happy, secure, stress-free future.

A Fulfilling Career

My job is satisfying because it’s a joy to help my clients achieve their dreams and do everything they hope to, whether it’s giving, saving, or spending. There’s just nothing like celebrating with a client when they learn they can retire the way they want.

And since I’ve always looked up to my dad and wanted to follow in his footsteps, I’m motivated to keep moving forward in my work to improve life not just for myself but for those around me. I work hard every day not just to carry on his legacy, but also to glorify God with my work and provide for my own family.

Your Turn

Now that you know a bit about me, I’d love to hear your story. What are you looking for in a financial planner? What challenges do you currently face as you get closer to retirement? Schedule an introductory appointment online or by calling us at 608-348-2274. For any questions, feel free to reach out to me at jacob@rosemeyermg.com.

About Jacob

Jacob Rosemeyer is owner and chief executive officer at Rosemeyer Management Group, an SEC Registered Investment Advisor based in Platteville, WI. Jacob is passionate about helping people retire comfortably and celebrating with them when they reach financial milestones. He provides integrated planning and investment strategies for growing and preserving clients’ wealth, and designs personalized wealth management solutions that include estate planning, risk management, tax planning, and retirement planning. Jacob is known for educating his clients and going the extra mile to ensure they know they are valued. He has a bachelor’s degree in business management from Edgewood College and grew up in Platteville, WI. Outside of the office, Jacob enjoys spending time with his wife, Andrea, and their three daughters, and investing in his faith by leading Bible studies and a men’s group, acting as parish council president at St. Mary’s Catholic Church, and serving on the board of directors for a pro-life clinic. He also enjoys sports and music. To learn more about Jacob, connect with him on LinkedIn.

There’s nothing one-size-fits-all about one’s financial life, so why follow a one-size-fits-all approach to retirement planning? As an independent financial services firm, Rosemeyer Management Group understands that every person’s situation is unique and that there is no cookie-cutter approach to retirement and income planning. That’s why we’ve created a process that is designed to help pre-retirees and retirees plan for and enjoy their much-anticipated retirement years.

Making Planning A Priority

Preparing for retirement requires more than just contributing to an IRA and hoping for the best. That’s why we provide comprehensive financial planning—addressing every question and concern you have, including ones you haven’t thought of yet. Before we even look at the numbers, we dive deep into your goals, dreams, worries, and fears to develop an understanding of you and your life. From there, we start designing a road map that prioritizes your needs and wants and gives you a clear path to make them a reality.

We leave no stone unturned as we build out each area of your financial life (after all, your savings accounts don’t exist in a bubble!), incorporating tax efficiency, estate planning, insurance analysis, investment management, Social Security claiming strategies, cash flow analysis, and more. Both the 30,000-foot view and the on-the-ground implementation help you make decisions and stay on track, no matter what life throws your way.

Crunching The Numbers

Your retirement will not look like anyone else’s. That’s why there’s no generic dollar amount that everyone needs to have in order to retire securely. Every individual has different sources of income, a different cost of living, and a different risk tolerance that all must be taken into consideration to determine retirement readiness. Our customized planning focus helps you map out various retirement scenarios to see what your savings can handle, giving you the knowledge and confidence to make decisions that will get you where you want to go!

Updating And Adapting

Life isn’t static. Neither is your financial plan. It’s critical to update your plan every year and adjust it as life changes occur, whether it’s a health crisis, a global pandemic, or relocating. We believe that retirement planning is a process, not a product. Our retirement calculators give you a picture of where you could be in 5, 10, or even 20 years; but more than that, they help you prepare for the unexpected and pivot when necessary. We consistently monitor our clients’ plans to ensure they are on track to carry them to their ideal future.

Are You Ready For A Different Kind Of Financial Plan?

If you want to get to the reward you deserve after working your whole life, we’d love to help you create a retirement plan that makes sense and leaves you with the confidence you have only dreamed about. Start your financial planning journey today by scheduling an introductory appointment online or calling 608-348-2274. For any questions, feel free to reach out to me at andrew@rosemeyermg.com.

About Andrew

Andrew Tranel is co-owner and chief investment officer at Rosemeyer Management Group, an SEC Registered Investment Advisor based in Platteville, WI. With 10 years of experience, Andrew specializes in providing retirement planning, tax planning, estate planning, and insurance needs for his retiree and pre-retiree clients with the goal of helping them develop a road map to financial freedom. He is known for his expertise in helping people make empowered and educated decisions about their retirement so they can confidently navigate the pre-retirement challenges they face. Andrew has a bachelor’s degree in finance and sport management from Loras College and is a CERTIFIED FINANCIAL PLANNER™ (CFP®) professional. When he’s not working, you can find Andrew spending time with his wife, Kimberlee, their three sons, Steven, Elliott, and Weston, and their beloved boxer, Bella. He also enjoys hunting, golfing, playing basketball and softball, and traveling. To learn more about Andrew, connect with him on LinkedIn.

Recently our clients approached us with a dilemma. This couple wanted to retire a few years early without hurting their retirement to spend their golden years doing what they loved to do as a couple: travel. However, they needed our help to create a plan that enabled them to do so.

At Rosemeyer Management Group, we love helping our clients implement the financial tools today that will enable them to reach their retirement goals tomorrow. In this article, we describe how we helped this particular couple achieve their goal of retiring early to chase their post-career life goals.

Client Background

This couple had been with Rosemeyer Management Group for about three years. They had a blended family, the wife with two children from a previous relationship that were now adults; and with a four-year age gap, she had already retired. They also loved to travel and had been planning their dream trip for quite some time: a 30-day South American tour that stopped on the frozen continent of Antarctica.

They wanted to start their retirement adventures as soon as possible and wanted to know if they would be able to manage a full retirement if the husband retired at age 60. Having a blended family also prompted a disagreement over who would receive what upon their death. They also underestimated how much they were spending by over $20,000 per year.

Our Client-Based Solutions

The most important thing that we can do for a client is to create an accurate cost-of-living assessment. As we stated before, this couple was operating on a financial plan in which they had underestimated how much they were spending by over $20,000 per year. Once we corrected this oversight, we then created a plan that would allow for the husband to retire at 60 so they could spend more time together traveling. We also came up with a strategy to bridge the years between when he was receiving his employer-sponsored health insurance and the year that he would become eligible for Medicare.

As far as the disagreement over the estate, we ended up connecting them with an attorney who specializes in this area. With the help of this attorney, the couple was able to talk through several major issues and ended up establishing a living trust.

In examining their wealth management strategy into retirement, we discovered that a good amount of their assets were in a pre-tax 401(k) account. We established a plan that would convert some of those dollars to a Roth account once the husband had retired and was no longer receiving a salary. We also reviewed the couple’s portfolio to ensure that it was appropriately invested to withstand risks and market volatility.

Finally, we reviewed several existing life insurance policies that had been overlooked for years and found that the policies could pay the premiums.

What Successful Retirement Looks Like

With our help, this couple will be able to live out their adventures in retirement as they had planned. The husband was able to retire at age 60, and although COVID-19 has slowed down their traveling plans for the moment, the couple is looking forward to many more years of traveling together. All in all, the couple has a solid wealth management plan and is prepared to manage their retirement with all the confidence they deserve.

We Are Here For You

If you are concerned about your wealth management plan or have a question about your retirement, we can help. Schedule an introductory appointment online or call 608-348-2274 to schedule an introductory appointment. For any questions, feel free to reach out to me at kaley@rosemeyermg.com.

About Kaley

Kaley Bockhop is an investment advisor representative at Rosemeyer Management Group, an SEC Registered Investment Advisor based in Platteville, WI. Kaley’s experience in taxes and accounting and her financial planning expertise allows her to help her clients work toward their retirement goals and set themselves up for success. It is Kaley’s goal to partner with her clients to build a customized road map for their finances so they can look forward to a comfortable retirement and decrease financial worry. Kaley is a CPA and a CERTIFIED FINANCIAL PLANNER™ professional. She has a bachelor’s degree in science from the University of Wisconsin-Platteville with a triple major in accounting, agricultural business, and animal science, and a minor in biology. In her free time, Kaley enjoys working on her family’s farm where they raise nationally recognized registered Angus show cattle. She also loves exercising and traveling. To learn more about Kaley, connect with her on LinkedIn.

Sometimes it is the most challenging moments in life that are the most formative. At least that was the case for me. When I was 19 years old, my father passed away. In addition to the emotional pain we all endured with his passing, I then had to watch my mom struggle to navigate our family’s finances. Dad had handled everything from bills to taxes to retirement, and my mom had to learn everything from scratch. Helping my mom through the process laid the foundation for my interest in finance. Then I had an opportunity in college to take on an internship in the financial industry. It was during that internship that I found so much joy in helping individuals retire well and knew that I wanted to spend my life making this kind of impact on others’ lives.

Starting My Career

After graduating from Loras College with a bachelor’s degree in finance and sport management, I secured my first job as an investment advisor representative. I learned how to develop and manage portfolios with individual clients and build lasting relationships. As I progressed and eventually became a chief investment officer with Rosemeyer Management Group, I focused on providing my clients with comprehensive wealth management. My goal is to make sure each person I work with has a complete understanding of their financial plan from taxes to retirement planning and estate planning.

My Career Today

Today, as co-owner and chief investment officer at Rosemeyer Management Group, I get to do what I love every day. Our clients entrust us with an immense amount of responsibility, and I am driven to do my absolute best for each and every one of them. By creating a personal relationship with each client, I get to learn about their dreams and unique challenges. I’m able to provide tailored plans and individualized guidance for clients that fits their lifestyle. Then I get to celebrate their victories right alongside them and ensure that after working and saving their whole lives, they can retire comfortably!

Are You Ready For A Different Financial Future?

Your financial life doesn’t need to be defined by stress and uncertainty. We can work together to provide financial education and a road map tailored to your unique needs and goals. Reach out to me at andrew@rosemeyermg.com or schedule an introductory appointment here . When you partner with a trusted advisor, finances can become a tool to make your dreams a reality.

About Andrew

Andrew Tranel is co-owner and chief investment officer at Rosemeyer Management Group, an SEC Registered Investment Advisor based in Platteville, WI. With 10 years of experience, Andrew specializes in providing retirement planning, tax planning, estate planning, and insurance needs for his retiree and pre-retiree clients with the goal of helping them develop a road map to financial freedom. He is known for his expertise in helping people make empowered and educated decisions about their retirement so they can confidently navigate the pre-retirement challenges they face. Andrew has a bachelor’s degree in finance and sport management from Loras College and is a CERTIFIED FINANCIAL PLANNER™ (CFP®) professional. When he’s not working, you can find Andrew spending time with his wife, Kimberlee, their three sons, Steven, Elliott, and Weston, and their beloved boxer, Bella. He also enjoys hunting, golfing, playing basketball and softball, and traveling. To learn more about Andrew, connect with him on LinkedIn.